DSLA Launches to Layer II on Arbitrum

Bringing DeFi Risk Management to Arbitrum

Layer-two protocols are a key to scaling Ethereum, and Arbitrum is one of the fastest growing and most promising L2 solutions out there. Arbitrum’s active and passionate community enjoys high throughput and low cost transactions, while still benefiting from the security provided by Ethereum’s mainnet.

As Arbitrum offers full EVM support, porting DSLA Protocol over is fairly straightforward, and we’re beyond excited to launch on Arbitrum with DSLA v2.0! Launching with DSLA v2.0 means we can offer the Arbitrum community the full suite of our flagship risk management use cases and empower Arbitrum developers to add risk management capabilities into their dApps and protocols.

DSLA Arbitrum Token Information

| Token Address | 0x7ce746b45eabd0c4321538dec1b849c79a9a8476 |

| Arbiscan Information | arbiscan.io |

| Uniswap L2 Trading | app.uniswap.org |

What is DSLA? 🤔

DSLA is a Governance, Risk and Compliance (GRC) Automation Middleware that enables the downside-protected delivery of goods, services and digital assets without intermediaries. Using Service Level Agreements (SLA), a special type of risk management contract that DSLA has rebuit for mass adoption, vendors and users can offset risks and incentivize performance.

DSLA’s flagship use cases include:

- NFT Floor Price Protection

- Parametric Staking

- Peg Parity Protection

- Staking Performance Protection

Beyond the flagship use cases developed by the Core Team, DSLA Protocol can be used by developers to build out new and innovative SLA-based risk management solutions using the DSLA Developer Toolkit (DTK).

SLA 3.0 : Programmable, Peer-to-Peer, Collateralized

A service level agreement enables you to predict the performance of a service, good or digital asset, using any measurable parameter. Users and Liquidity Providers stake cryptocurrency to sign onto an agreement and receive or provide cover, respectively.

Performance is measured and compared with the pre-agreed performance target in the SLA, and rewards or compensations are then released depending on the outcome of that comparison.

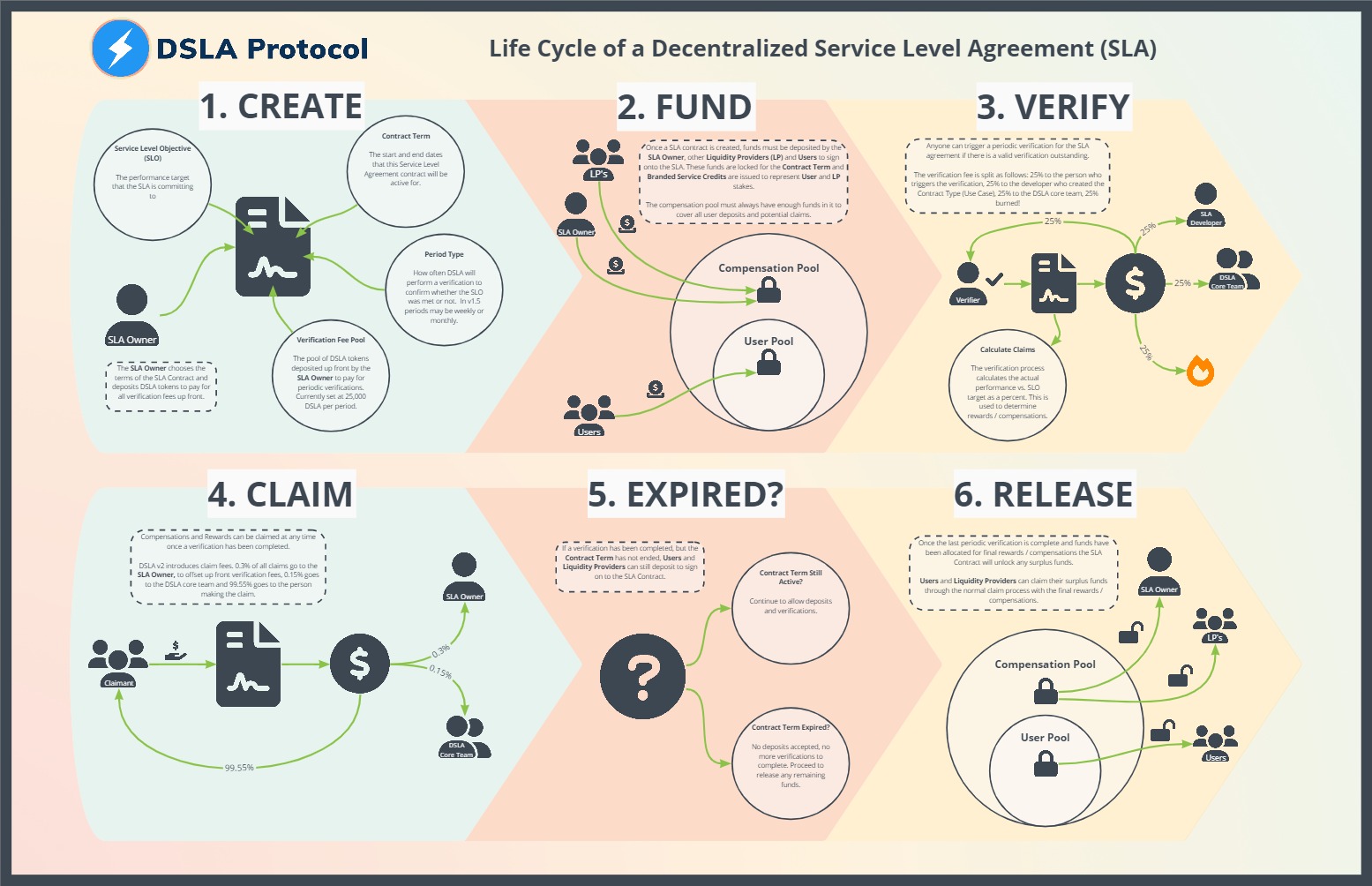

The below infographic provides an overview of the SLA Lifecycle in DSLA Protocol.

Developing New Use Cases to Manage Any Third Party Risk ⚡

DSLA’s Developer Toolkit (DTK) provides an easy way for developers to leverage the power of DSLA Protocol and add on-demand risk management services to their dApp or protocol. Fintech’s and Insurtech’s can use DSLA and the DTK to create new risk management products quickly, with minimal overhead and time to market.

Any measurable parameter that can be returned to an SLA contract can be used as the basis for setting performance targets, measuring performance, and allocating rewards or compensations. DSLA Protocol is an extremely flexible tool to manage risk for always-on services or digital goods.

Interested developers or projects can check out our develioper guide to get started!

Lastly, we’d be remiss if we didn’t mention that DSLA Protocol has built-in incentives too. Anyone who develops a new use case is entitled to a portion of the verification fees generated by that use case forever!

We can’t wait to see where DSLA and the Arbitrum community go!

💡 DSLA Protocol

GRC Automation Middleware

DSLA’s approach to integrated risk management enables the downside-protected delivery of goods, services and digital assets without intermediaries.

👉 Get started at dsla.network

👉 Read more at stacktical.com

👉 Check our blog at blog.stacktical.com

👉 Start Building at readme.stacktical.com

👉 Join our Guild at guild.xyz/dsla

👉 Check active bounties at dework.xyz/dsla

👉 Discuss on our governance forum at commonwealth.im/dsla