DSLA is live on Polygon/Matic, debuts low-fee L2 trading on the QuickSwap DEX

Fast swaps. Cheap fees.

Dear community, we are proud to announce that the DSLA token has been successfully added to the bridge of the Polygon network, formerly know as Matic! 🎉

DSLA tokens can now be transferred to the Polygon network via the Matic V2 wallet, and swapped on the QuickSwap decentralized exchange at very fast speeds and very cheap fees.

Crossing the Polygon bridge from Ethereum

In a couple minutes, you will be able to swap DSLA tokens on the QuickSwap exchange.

Step 0: Before your start

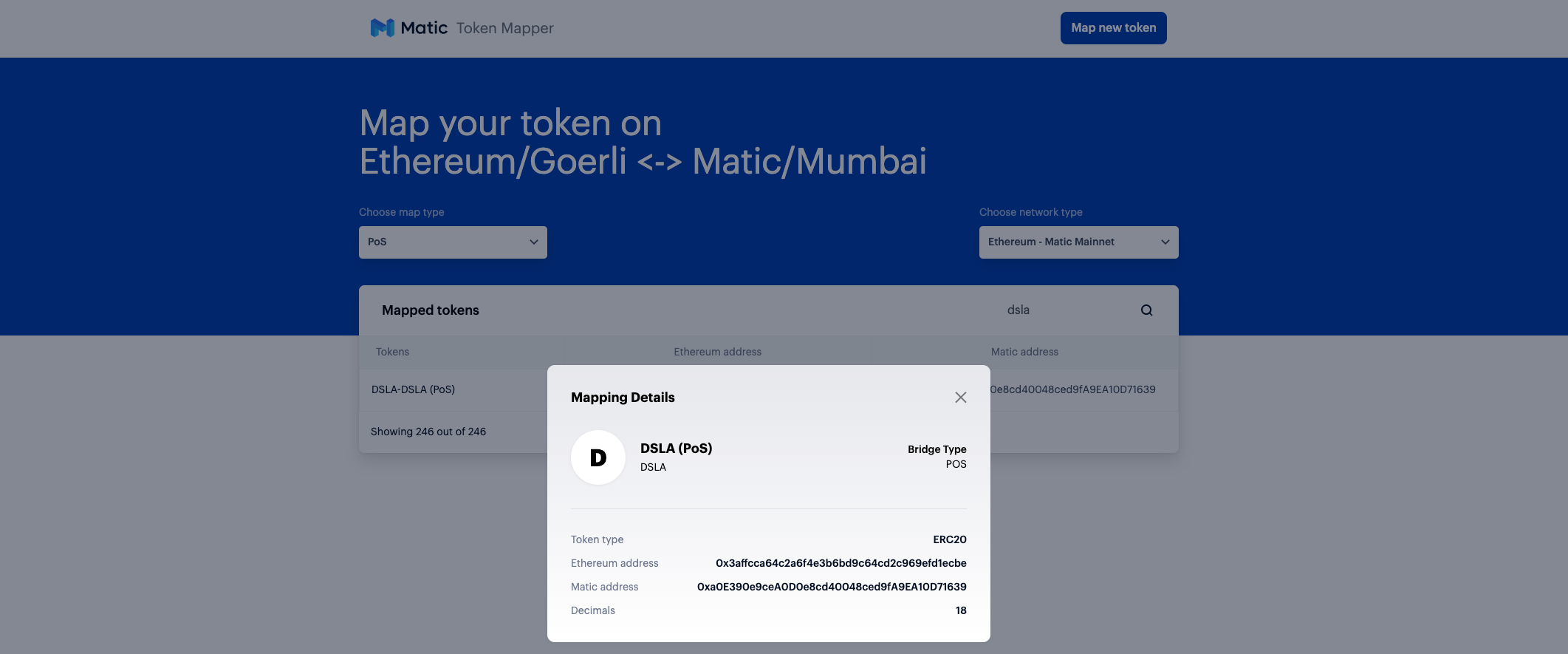

Please note that the official address of DSLA on the Polygon/Matic network is 0xa0E390e9ceA0D0e8cd40048ced9fA9EA10D71639.

This address is publicly available on the official Matic Token Mapper application at https://mapper.matic.today.

Step 1: Bridge your assets

Be aware that paying fees is required to move funds between the Ethereum blockchain network (Layer-1, or L1) and the Polygon/Matic sidechain (Layer-2, or L2).

But after making the jump to the Polygon network, all your DSLA swaps on Quickswap will only cost you 1/1000th of the fees you usually pay on Uniswap.

👉 Read the Matic V2 wallet tutorial here to learn how to move your ETH and ERC20 tokens between networks.

Step 2: The Swap

Once you have cryptocurrency available in your MATIC wallet, you will be able to purchase QUICK and DSLA tokens on the QuickSwap decentralized exchange.

👉 Swap QUICK/DSLA on QuickSwap now

Powered by Polygon

Polygon offers a Layer-2 (L2) scaling solution that overcomes the scalability bottlenecks of the Ethereum network using sidechains for off-chain computation, while still ensuring great level of security and decentralization.

Join the conversation on Telegram!

About DSLA Protocol

DSLA Protocol is a risk management framework that enables infrastructure operators and developers to reduce their users exposure to service delays, interruptions and financial losses, using self-executing service level agreements, bonus-malus insurance policies, and crowdfunded liquidity pools.

DSLA Protocol’s flagship use case is to offset the financial losses of Proof-of-Stake delegators and DeFi users, while incentivizing the connectivity, performance and availability of staking pool operators and DeFi service providers.

To learn more about DSLA Protocol, please visit stacktical.com, browse our official blog, and follow @stacktical on Twitter.