Hello, OpenSea World! NFT Impermanent Loss Agreements are coming to DSLA Protocol

Use DSLA to hedge against NFT market risks

Dear DSLA champions and cryptocurrency community, the DSLA core development team is proud to announce that we are adding support for Non Fungible Tokens (NFTs), to DSLA Protocol! 🎉

This important step of DSLA Protocol’s development will empower OpenSea and other Creators around the world to incentivise the purchase of their NTFs, and top-up their royalties using NFT Impermanent Loss Agreements.

Our strong belief is that NFTs are the future of media ownership, as well as one of the greatest ways to showcase, trade and distribute creative works ever invented.

But without a risk management vehicle to reduce customers exposure to market risks, NFTs will struggle to fulfill their mission as one of the defining asset classes of our generation.

The DSLA core development team is very excited by the upcoming release, and we cannot wait to share more about our OpenSea integration and NFT strategy, in the near future.

Introduction to Non Fungible Tokens (NFT)

A non-fungible token or NFT, is a special type of cryptocurrency that represents an asset that cannot be replicated. Although Creators can create any amount of NFT copies, each copy will remain unique, indivisible and rare.

This makes NFT an excellent fit for digital art, and collectibles in general.

NFT and Risk: What is Impermanent Loss?

Assuming you purchase NFT digital art and collectibles using ETH, NFT Impermanent Loss happens when the value of your NFT purchased in ETH, ends up being less than simply holding ETH.

In short, NFT Impermanent Loss is a byproduct of the volatility of ETH as a payment method.

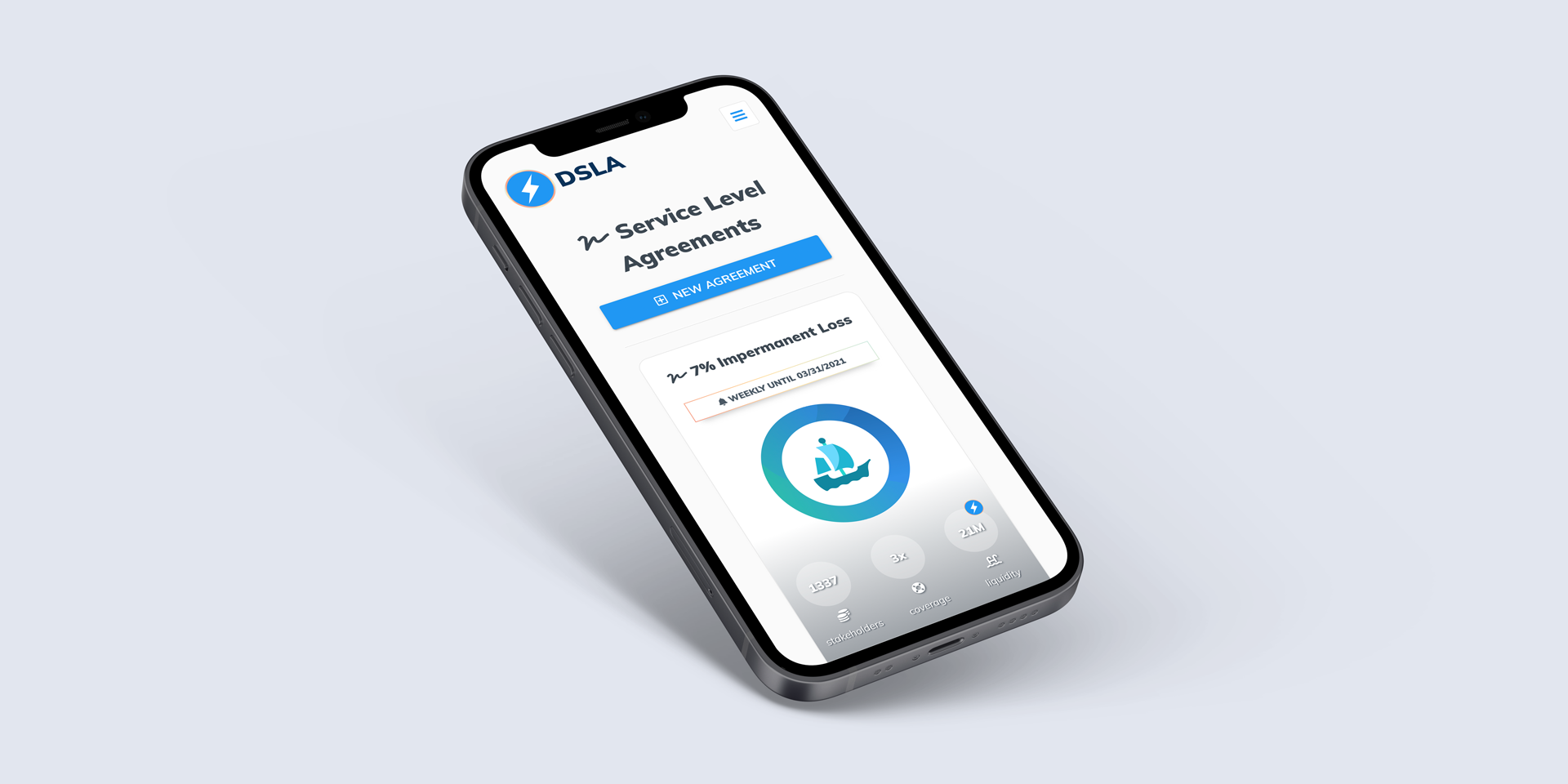

DSLA Protocol fixes this

By signing a DSLA contract, Creators and their customers agree on sanctioning price volatility, and on rewarding stability and growth, for a set period of time.

To activate an agreement, both parties need to put money when their mouth is, by staking DSLA, USDC or DAI to the DSLA contract liquidity pool.

When a NFT Impermanent Loss Agreement is active, DSLA Protocol monitors the NFT price, and the price of its underlying asset (e.g. ETH).

If the calculated Impermanent Loss stays within the thresholds of the agreement, Creators earn the right to claim a reward, by depleting the coverage stake of customers.

Conversely, whenever an agreement is violated, customers earn the right to claim a compensation, by depleting the upfront commitment of Creators.

Join the conversation on Telegram!

About DSLA Protocol

DSLA Protocol is a risk management framework that enables infrastructure operators and developers to reduce their users exposure to service delays, interruptions and financial losses, using self-executing service level agreements and bonus-malus insurance policies.

Its flagship use case is to offset the financial losses of proof-of-stake delegators and DeFi users, while incentivizing the good performance and reliability of staking pool operators and DeFi service providers such as Uniswap (AMM) and OpenSea (NFT).

To learn more about DSLA Protocol, please visit stacktical.com, browse our official blog, and follow @stacktical on Twitter.