How Can We Restore Confidence

Confidence and Trust Have Been Broken 🚨

2022 has been a difficult year for the cryptocurrency space, to say the least. With major, high-profile implosions that have rocked the industry as a whole and resulted in life-changing losses for many.

Confidence and trust are at an all-time low and recovering will be a long road.

Risk Management, as a product category, has historically struggled to be top of mind in the space. In many cases people are not generally interested in proper Risk Mangement until after they are in a situation where they already need it.

We need to work together to change that.

Using Decentralized SLAs to Restore Confidence 🛡️

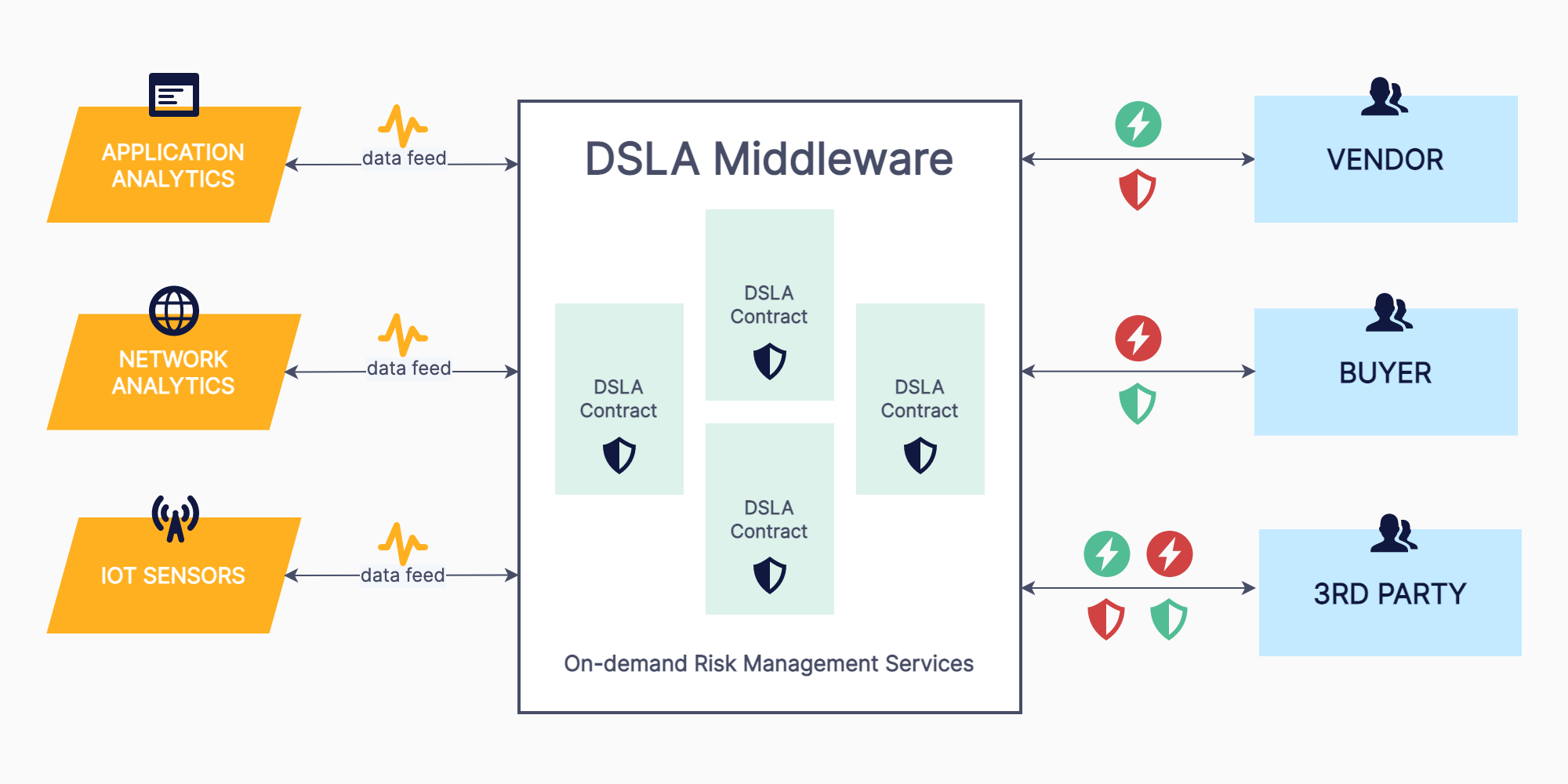

DSLA has rebuilt Service Level Agreements (SLA) for mass adoption and we believe that SLAs can be one of the cornerstone tools underpinning a crypto space that is focused on consumer protection, transparency, building trust and ensuring accountability.

While SLAs alone are not a panacea for the issues facing the crypto ecosystem, they are be a very powerful tool for the industry to start transparently self-regulating and offering embedded insurance for consumer protection.

Decentralized SLAs are powerful because they are collateralized, on-chain, and driven by objective third-party performance analytics.

DSLA v2 Ready to Go 🤝

With DSLA v2 being successfully deployed and active on Ethereum, Arbitrum, Polygon and Avalanche, we have the opportunity to provide a valuable and practical risk mangement tool to a large portion of the web3 ecosystem.

DSLA’s Risk Swap Widget will provide a simple interface that anyone can leverage to provide embedded insurance and risk swapping functionality.

Let’s take a quick look at some of the use cases and types of SLAs that are ready to be rolled out now that DSLA v2 is live.

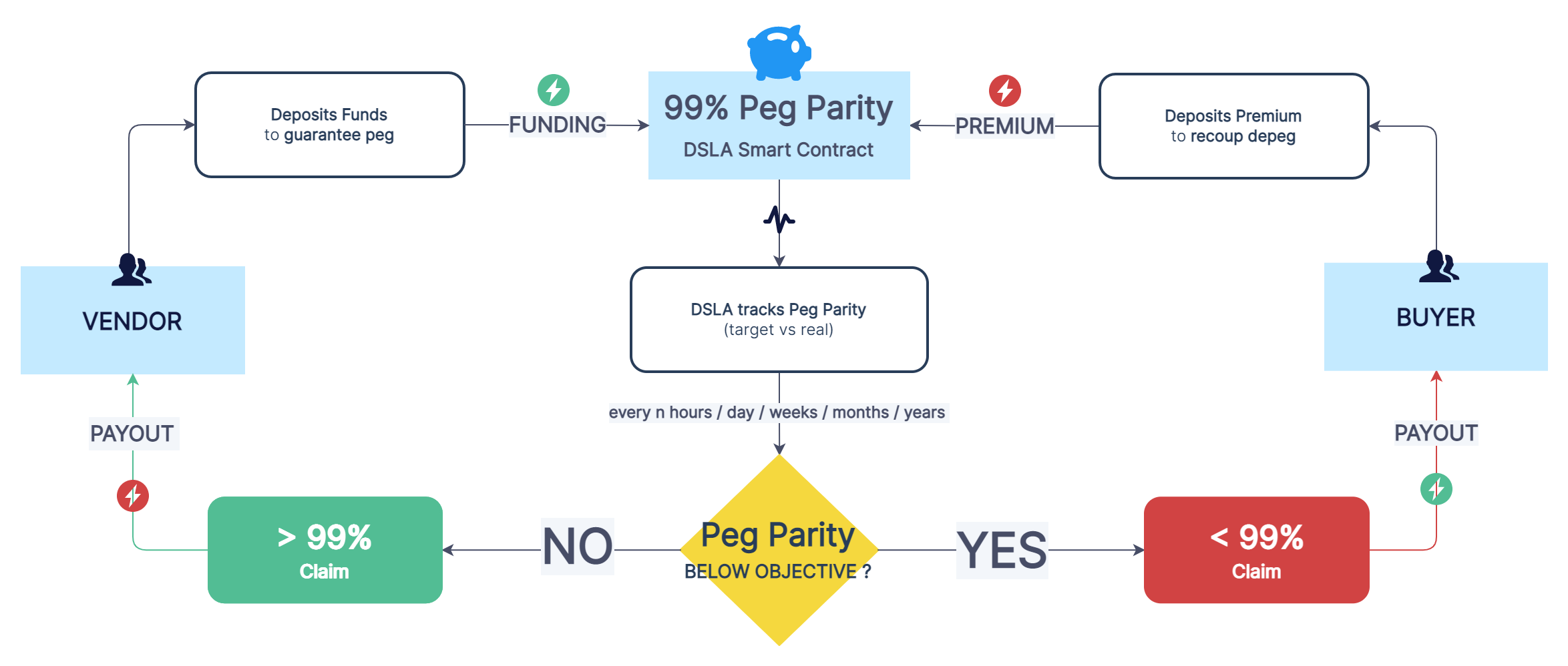

Peg Parity SLAs 🟰

A wide variety of pegged digital assets fall under this group. From stablecoins (whether collateralized or algorithmic) to liquid staking tokens to tokenized stocks. Pegged digital assets as a class will only continue to grow.

We’ve seen some spectacular failures in the pegged asset space such as the UST and Iron death spirals. Outside of those events, though, there are countless other examples of stablecoins and other pegged assets losing their peg.

With the FTX-crash driven volatility of the past few days we are seeing a number of issues with pegged assets. Stablecoins such as USDD and even USDT have depegged at times.

Also as a result of the FTX fallout, Solana ecosystem tokens are experiencing significant volatility and liquid staking tokens like mSOL are not maintaining their exchange peg.

Liquid staking tokens like stETH have previously had issues maintaining peg as well.

Peg Parity SLAs allow for pegged asset issuers to back their product in a collateralized, transparent and objective manner. Consumers can sign on and receive protection against depeg risks with a pre-agreed target performance.

@justinsuntron, let’s talk about a Peg Parity SLA for USDD.

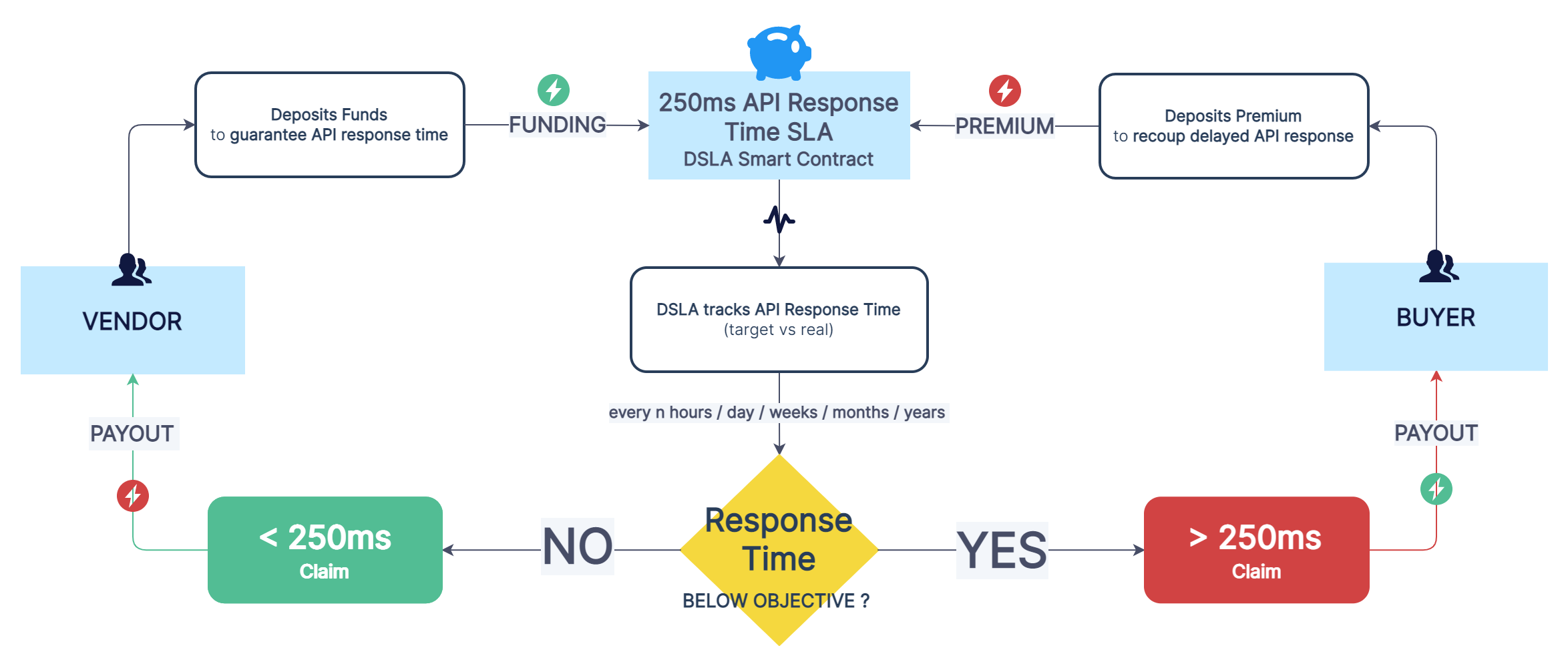

Uptime and Response Time SLAs 💡

During times of high volatility, uptime and response time performance can become critically important. We’ve seen many cases of this during the extreme volatility over the past several days.

Even outside of extreme events, consistent, reliable and responsive API performance is critical to many users and applications.

Companies that are customer-service oriented and have confidence in their product can collateralize their API performance to provide customers with a performance guarantee that is more than just words.

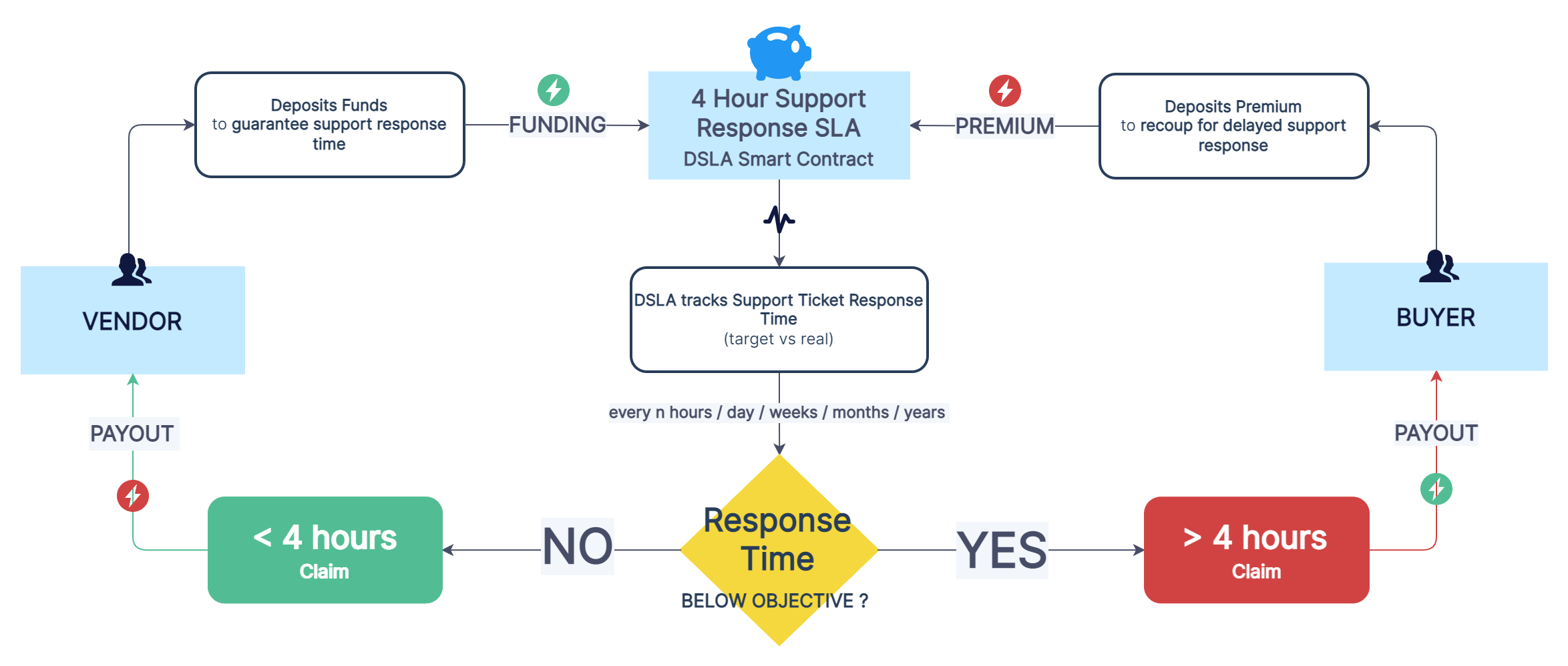

In the same category, an SLA could provide real backing for guaranteed Customer Support and Issue Resolution response times that are often “guaranteed” (but with no real recourse or remedy if missed) to premium customers.

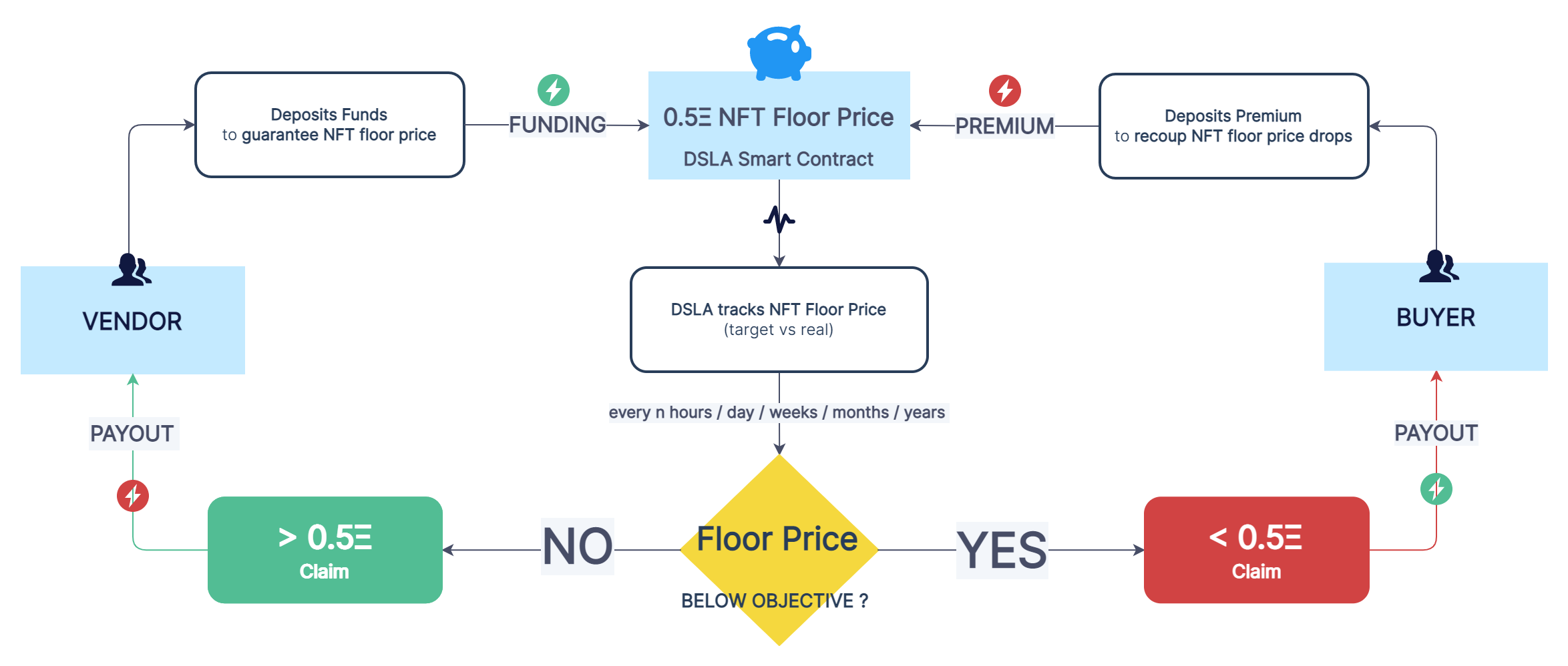

Asset Floors and Depreciation SLAs 📉

The NFT market has shown to be just as risky as the general crypto coin market that came before it. There are endless examples of scams, rugs and vaporware.

Some projects certainly are legitimate, but even with them NFT collectors have had no real option to hedge the downside risk of holding certain NFTs.

NFT Floor Price Protection is a new use case rolling out imminently, powered by DSLA. It will allow users to hedge against the risk of floor price drops for NFTs they own.

For new NFT projects, NFT Floor Price Protection can be used to provide consumer confidence and protection. New projects can collateralize an NFT Floor Price Protection SLA to back the fact that their project is not a scam, rug or vaporware.

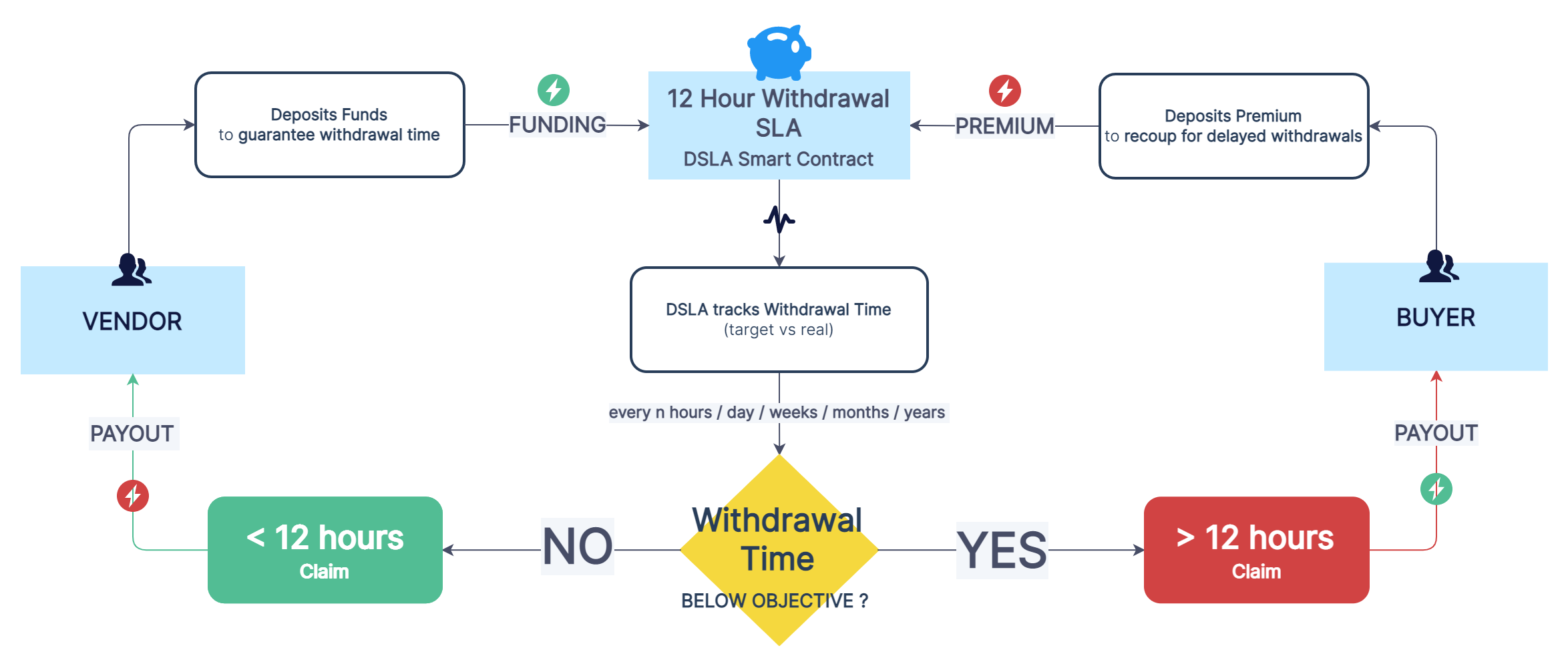

Withdrawal and Transfer Time SLAs 💸

Providing customers a withdrawal time commitment should be standard practice by now for crypto exchanges. These commitments should further be collateralized and backed, providing a real guarantee and real compensation to customers when targets are not met.

Exchanges of the world, we stand ready to give you an edge by providing integrated insurance that guarantees withdrawal times for your customers.🫡

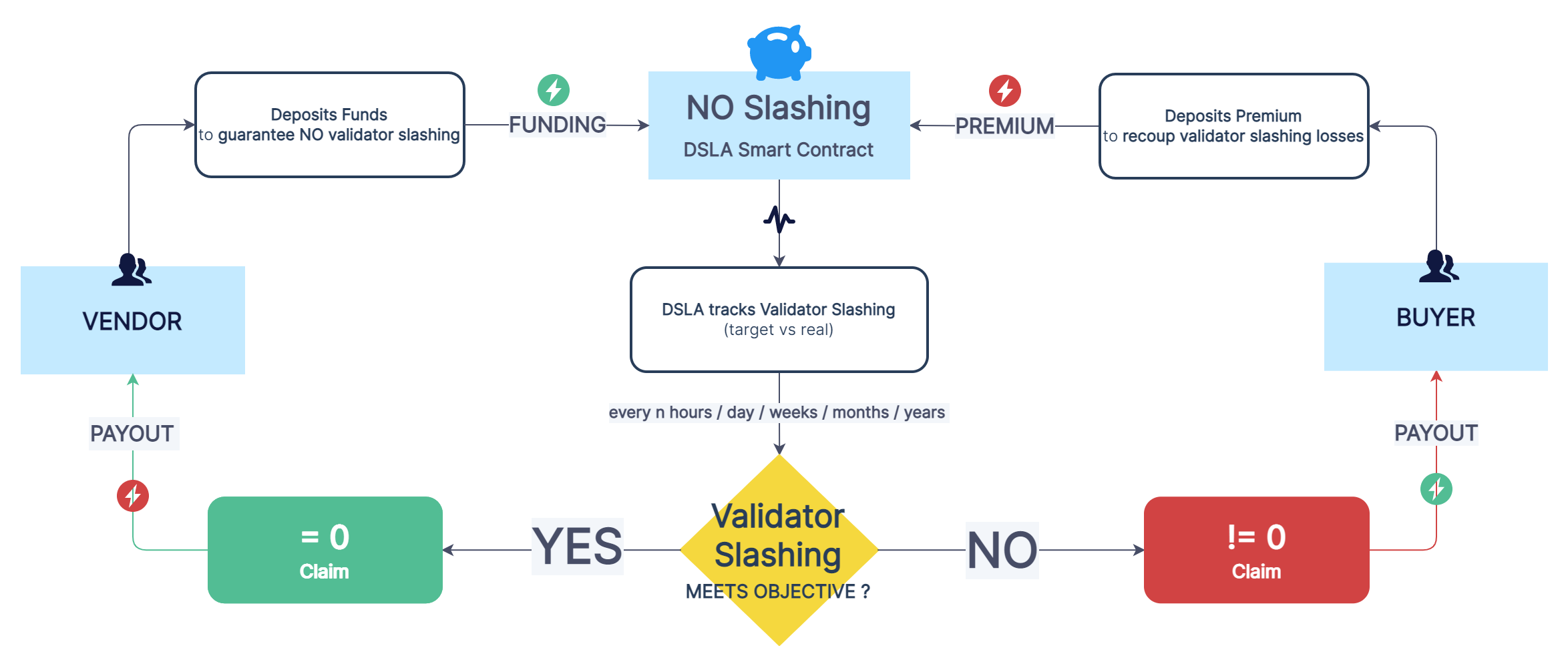

Delegator Staking Protection SLAs 🪙

Staking service providers can easily leverage DSLA to provide peace of mind to delegators, guaranteeing either staking rewards performance or that their validator will not incur any slashing penalties.

Deadline SLAs 📅

While the Deadline SLA has not been developed yet, we can see a true need for it in the space to hedge against the risk of roadmap deadlines not being met.

A Deadline SLA could be collateralized by a team to commit to meeting certain roadmap deliverables. This could be combined with something like reality.eth for a data source to confirm deliverables were met or missed.

You could even use a Deadline SLA to provide embedded insurance for new NFT sales or coin offering raises. Doing so would lock raised funds into a SLA, to be released upon meeting of certain milestones that are set and agreed in advance.

Embedded insurance options like this could make the space drastically safer for consumers.

Any Good, Service or Digital Asset 💪

DSLA is an SLA Automation Middleware and is designed to be easily leveraged to build and deploy new use cases.

In the DubaiDeFi Hackathon one of the participants built a working Peg Parity SLA using the DSLA Developer Toolkit (DTK) in less than a day!

As a risk management middleware, DSLA can be leveraged to provide integrated insurance against any kind of parametric risk.

We’re excited for DSLA to be a part of the solution to the current crisis of confidence in crypto. Connect and build with us 👇.

💡 DSLA

GRC Automation Middleware

DSLA’s approach to integrated risk management enables the downside-protected delivery of goods, services and digital assets without intermediaries.

👉 Get started at dsla.network

👉 Read more at stacktical.com

👉 Check our blog at blog.stacktical.com

👉 Start Building at readme.stacktical.com

👉 Join our Guild at guild.xyz/dsla

👉 Check active bounties at dework.xyz/dsla

👉 Discuss on our governance forum at commonwealth.im/dsla